Government-Mandated

E-Invoice Made Simple

Trusted by over 270,000 Malaysian businesses, SQL Account ensures your company stays compliant with LHDN requirements while keeping things simple and hassle-free.

Power up your business and career from zero to expert

Kick Start:

Introduction

to e-invoice

Begin your journey with an introduction to E-Invoice and SQL system basics, with no prior experience required. Gain a comprehensive understanding of key concepts, practical knowledge, and the latest LHDN guidelines.

Essential:

Practical

Implementation

Build hands-on skills with step-by-step implementation training using SQL Accounting Software. Learn through real-world business scenarios to confidently apply the full E-Invoice process.

Advanced:

Master

Operations

Master your operational workflows with in-depth training on key modules and E-Invoice integration. This session covers the complete Stock module, Advanced features, and the Production module to support complex business operations.

Professional:

Certified

Expertise

Master advanced E-Invoice workflows with step-by-step hands-on training tailored for certified professionals and consultants. This session also deepens your understanding of ACCA principles and key tax regulations to ensure full compliance in real-world scenarios.

Sessions Conducted In: Mandarin / English

Registration: Direct Payment (Early Bird: RM299) | HRD Claimable (RM399)

Why Choose SQL Accounting For E-Invoice?

TIN Search Made Easy

SQL has over 1.4 million business records built-in, allowing you to seach for customer TIN numbers directly with no more chasing customers for the TIN!

👉 Save time, reduce hassle, and ensure accuracy.

Batch Submit to LHDN Portal

👉 Perfect for businesses with large transaction volumes!

Flexible Submission Window

(Over 720 Hours! )

👉 Give your team breathing space and better error handling!

One-Click Import Purchase Invoices from LHDN Portal

👉 Avoid manual entry and minimize errors.

Smart QR Code for E-Invoice Data Collection

👉 Boost customer response rates and streamline the process!

How SQL Accounting Assists Your Business in Adhering to LHDN E-Invoice Requirements?

Simplify Your E-Invoicing with SQL Account:

Comply easily with LHDN’s latest e-invoicing requirements. SQL Account automatically fills and stores all 55 required fields, including 35 mandatory and 20 optional fields, so you do not need to repeat manual entries.

Real Time E-Invoice Tracking:

Monitor every invoice status such as submitted, validated, invalid, or cancelled directly in SQL Account. Stay updated and manage all your e-invoices with ease.

Full Compliance for All Transactions:

SQL Account fully supports transactions required by LHDN including dividends, foreign income, agent payments, foreign purchases, and cross border dealings, helping your business remain fully compliant.

E-Invoice

Consolidated E-Invoice

Self-Billed E-Invoice

Our LHDN E-Invoice Features

MyInvois Ready Company Profile

SQL Account equips you to finalize your company profile with all necessary details for E-Invoice submission. It also highlights any missing information to ensure your profile is MyInvois Ready. We can now allow you to use the LHDN Preprod API for testing.

E-Invoice

Our streamlined invoicing process incorporates standard E-Invoice submission to MyInvois with a simple button click. It facilitates both individual and bulk submissions and provides you with the submission status and a countdown of 72 hours for any changes needed.

Consolidated E-Invoice

Certain businesses can submit consolidated E-Invoices once a month. SQL Account provides a user-friendly interface for submitting multiple invoices as a single consolidated E-Invoice to MyInvois.

Self-Billed E-Invoice

If suppliers cannot provide an E-Invoice, compliance is still necessary. For registered companies, an E-Invoice must be obtained. For individuals ineligible to issue E-Invoices, you must issue a self-billed E-Invoice. With SQL Account, you can easily submit purchase bills as a self-billed E-Invoice to MyInvois with one click.

Seamlessly Import Transaction from Supplier E-Invoice

Easily integrate supplier transactions into your SQL Account by importing E-Invoices directly from suppliers. This process eliminates manual data entry, ensuring accuracy and saving time. Import all relevant transaction details quickly, keeping your records up to date.

Cancelling an E-Invoice

You can cancel an E-Invoice, with a stated reason, within 72 hours of its submission to MyInvois. SQL Account features a countdown timer that indicates which invoices are still eligible for cancellation. This action can be easily performed in SQL Account with just a click

One Payment, Lifetime Usage

Say goodbye to recurring fees. Make one investment for permanent access to e-invoice compliance.

One Time Payment

E-Invoice

>LHDN & MyInvois Compliant

Secure and Reliable

Seamless Integration

User-friendly and easy setup

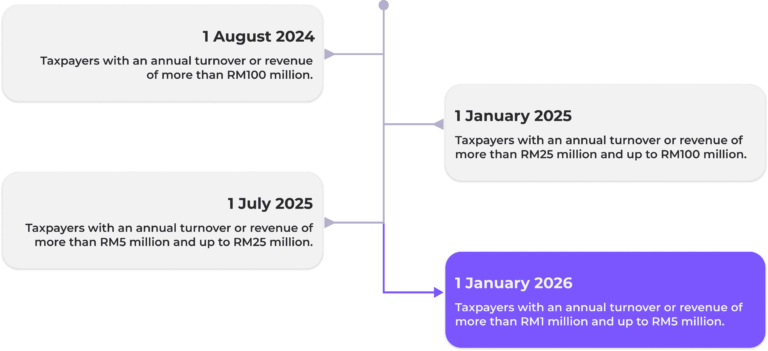

E-Invoice Implementation Timeline:

Taxpayers with an annual turnover or revenue of more than RM5 million and up to RM25 million.

Taxpayers with an annual turnover or revenue of more than RM25 million and up to RM100 million.

Taxpayers with an annual turnover or revenue of more than RM1 million and up to RM5 million.

Taxpayers with an annual turnover or revenue of less than RM1 million.

Built-in Compliance

SQL Account ensures your e-invoices and SST adhere to all LHDN regulations, saving your time and minimizing errors

1 Software, 3 Platforms

SQL Account provides three powerful features: a customizable on-premise system tailored to your workflow, flexible cloud services for accessibility anytime, and a mobile app for issuing e-invoices from any device. These components are seamlessly integrated for a cohesive experience.

Expert Support

Our team of e-invoice specialists has in-depth knowledge of the e-invoice mandate and is here to guide you every step of the way.

Ready to Implement E-Invoice for Smoother Operations?

E-Invoice Articles

E-Invoice Tutorial Video

Ready to Implement E-Invoice for Smoother Operations?

Secure Your Business Compliance Today

Join over 320,000 Malaysian business owners who trust SQL Account for LHDN-compliant invoicing solutions.