Dear SQL users (or non-SQL users yet), thank you for visiting SQL Income Tax Calculator.

Currently LHDN has released latest tax rate but yet to release the tax relief (pelepasan cukai) for YA 2023. (As of 19 Dec 2023)

However, we gain some helpful information from user feedback and therefore we created a draft version of YA 2023 income tax calculator.

To estimate your tax, you may use our YA 2022 income tax calculator or draft of YA 2023 income tax calculator below for the time being.

We will create the best income tax calculator for you once we find out that LHDN has published tax reliefs for YA 2023. Please notify us as soon as possible if you notice that LHDN has published tax details for the YA 2023 as well.

We are grateful for your contribution to making our service even better.

SQL Professional Tax Calculator & Tax Planner Malaysia

for Income Tax 2025

Income Tax Summary YA 2024

Gross Income Before Deduction

40,000

Tax Deductions

- 9,000

Individual / Spouse Relief

9,000

Child Relief

0

Parent Relief

0

Other Relief

0

Taxable Income

31,000

Tax Amount

480

5,000 x 0% = 0 15,000 x 1% = 150 11,000 x 3% = 330 Less Zakat

- 0

Less Tax Rebate

- 400

Tax You Should Pay

RM 80

Average Tax Rate

(80/31,000

) x 100% = 0.2%

|

Income Tax Summary YA 2024

Gross Income Before Deduction

40,000

Tax Deductions

- 9,000

Individual / Spouse Relief

Individual & dependent relatives

9,000

Taxable Income

31,000

Tax Amount

480

5,000 x 0% = 0 15,000 x 1% = 150 11,000 x 3% = 330 Less Zakat

- 0

Less Tax Rebate

- 400

Tax You Should Pay

RM 80

Average Tax Rate

(80/31,000

) x 100% = 0.2%

|

Assessment Year 2024

| Chargeable Income | Calculation (RM) | Rate % | Tax RM |

|---|---|---|---|

|

0 - 5,000 |

On the First 5,000 |

0 |

0 |

|

|

On the First 5,000 |

|

0 |

|

|

On the First 20,000 |

|

150 |

|

|

On the First 35,000 |

|

600 |

|

|

On the First 50,000 |

|

1,500 |

|

|

On the First 70,000 |

|

3,700 |

|

|

On the First 100,000 |

|

9,400 |

|

|

On the First 400,000 |

|

84,400 |

|

|

On the First 600,000 |

|

136,400 |

|

|

On the First 2,000,000 |

|

528,400 |

Categories Of Tax Relief In Malaysia

Individual & Family Tax Relief

Starting off would be the Malaysian individual tax relief. Every individual is entitled to RM9,000.00 tax relief.

A household can claim RM4,000.00 tax relief for their non-working spouse. Households with children under the age of 18 years old can claim RM2,000.00 per child. There is also tax saving criteria of RM6,000.00 if the child is disabled (OKU). In addition, households with children above the age of 18 who are still receiving a full time education in a higher learning institution can claim tax relief of RM8,000.00.

Additional personal tax relief is also given if a person is disabled or married to a disabled person. RM6,000.00 of additional personal tax relief if an individual is disabled and tax relief of RM3,500.00 if the spouse is disabled.

Individuals who are financially supporting their retired parents above the age of 60, can claim tax relief of RM1,500.00. Parents must be Malaysian residents and earn under RM24,000.00 annually.

Expenses Entitled For Tax Relief Claims

Education:

- A maximum amount of RM 7,000.00 of tax savings are given for education fee/qualifications at tertiary level or postgraduate studies.

- Parents who deposit into the National Education Savings Scheme for their Children can claim up to RM8,000 in tax savings.

Medical Insurance, Life Insurance & EPF:

- Tax benefits of RM 3,000.00 for insurance premium for yourself or your child.

- RM 4,000.00 claimable tax relief or EPF contribution.

Medical Expense:

- Parents Medical Expenses : RM8,000 tax savings on medical expenses for parents who suffer from physical or mental disabilities, require treatments. Includes home care centres, and day care centres.

- Self Medical Expenses : RM8,000.00 tax savings on self medical expenses. Inclusive of autoimmune illnesses like AIDS, Parkinson’s, Cancer, Kidney failure.

Lifestyle Expenses:

- Purchases of books, sports equipment, smartphones, gym memberships, computers, and internet subscription are allowed up to RM2500 tax relief.

- Additional RM2,500 tax relief for purchases of personal computers, laptops, smartphones and tablets made between 1 June 2020 until 31 December 2021.

- Additional tax relief of RM500 for any expenditures related to purchase of sporting equipment, rental of sporting facilities, payment of registration or competition fees.

- Domestic travel (travelling within Malaysia) expenses have RM1,000.00 tax relief.

- Get tax saving worth RM3,000.00 for childcare expenses for children up to 6 years old.

- There are unlimited tax reliefs for Zakat expenses for Muslims who have to make this compulsory contribution.

- Supporting expenses tax relief of RM6,000.00 when it comes to the expense of purchasing basic equipment to support a disabled self/child/parent/spouse.

- Women with children can claim RM1,000.00 tax relief on breastfeeding equipment every 2 years.

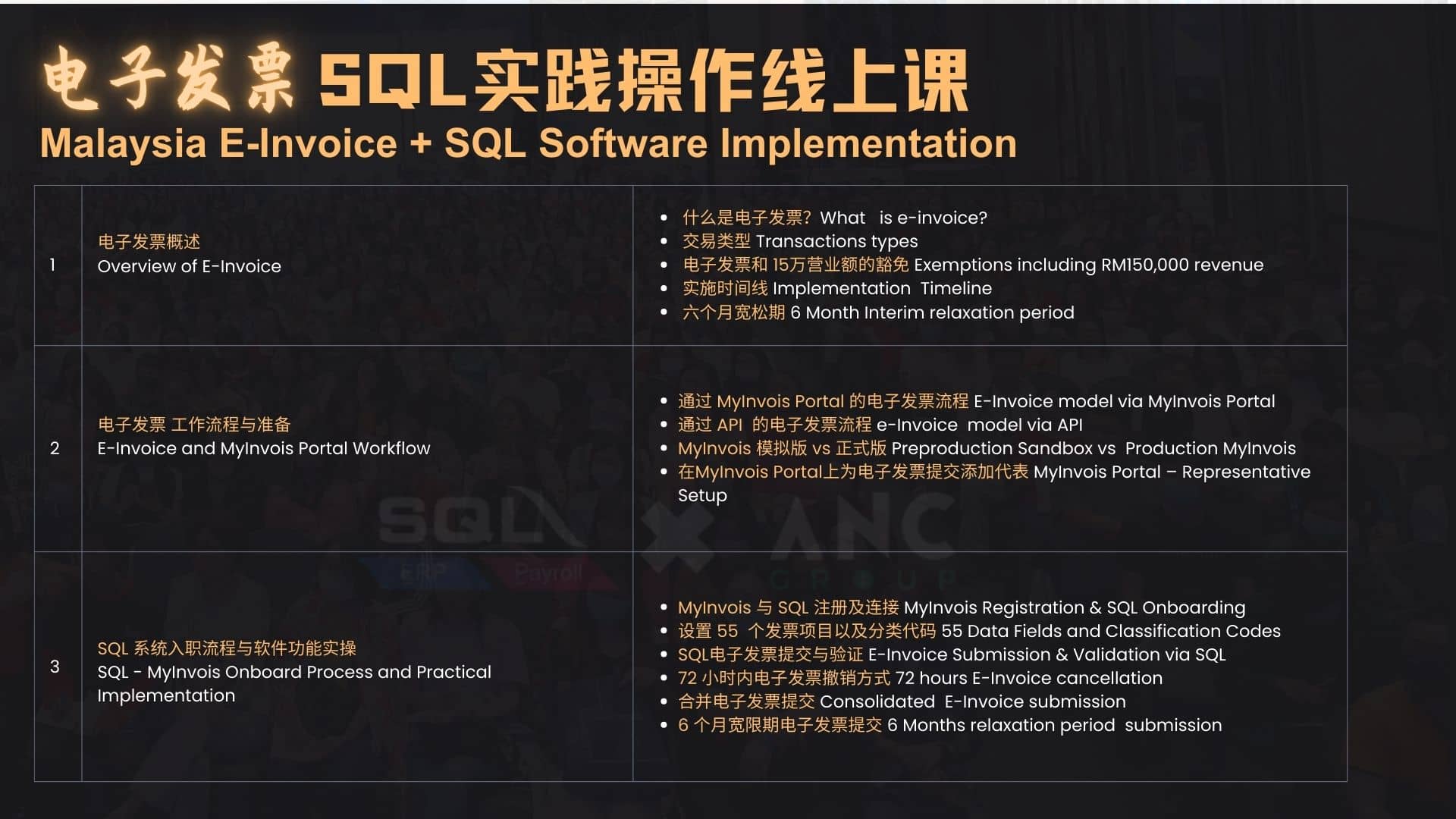

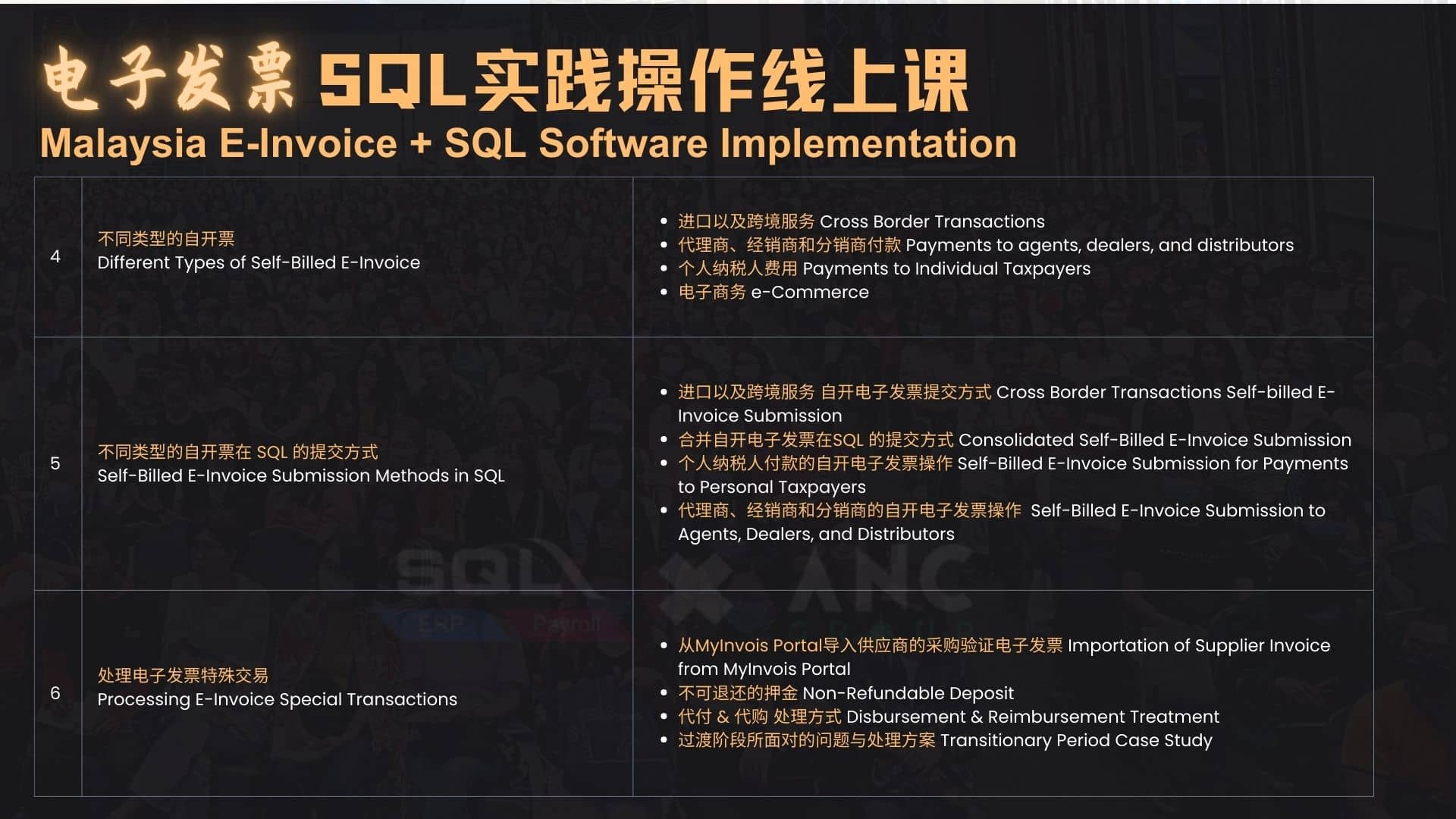

Why Struggle alone? Get Step-by-Step Guidance

– Learn from E-Invoice & SQL Experts!

As Malaysia’s mandatory e-Invoice rollout nears, the SQL & ANC Practical E-Invoice Online Course –【June Extended Edition】 offers a step-by-step, hands-on training designed to ensure you truly understand, apply, and master the full submission process. From MyInvois and SQL system integration to configuring 55 key fields and handling complex transactions, our expert trainers Mr. Song Liew & Ms. Meldy Ong will guide you every step of the way. With extended time until 4PM at no extra cost, this HRD-claimable course ensures you can confidently manage e-Invoicing in real business scenarios. Early bird price remains at RM299—limited slots available!

.

马来西亚电子发票政策即将全面落实,【SQL & ANC 联合主办|6 月 加长版 电子发票实战操作课】将以手把手、一步一步带您掌握从LHDN系统设定到实际提交的完整流程。课程涵盖 MyInvois 与 SQL 系统对接、55 项关键字段设定、复杂交易处理及合规技巧,由两位讲师Mr. Song Liew & Ms. Meldy亲授,确保您听得懂、学得会、操作得出。课程延长至下午 4PM,无需额外收费,HRD 100% Claimable,早鸟价仍为 RM299,名额有限,立即报名!