Form TP1, TP2 & TP3 Malaysia

What is the purpose of form TP1?

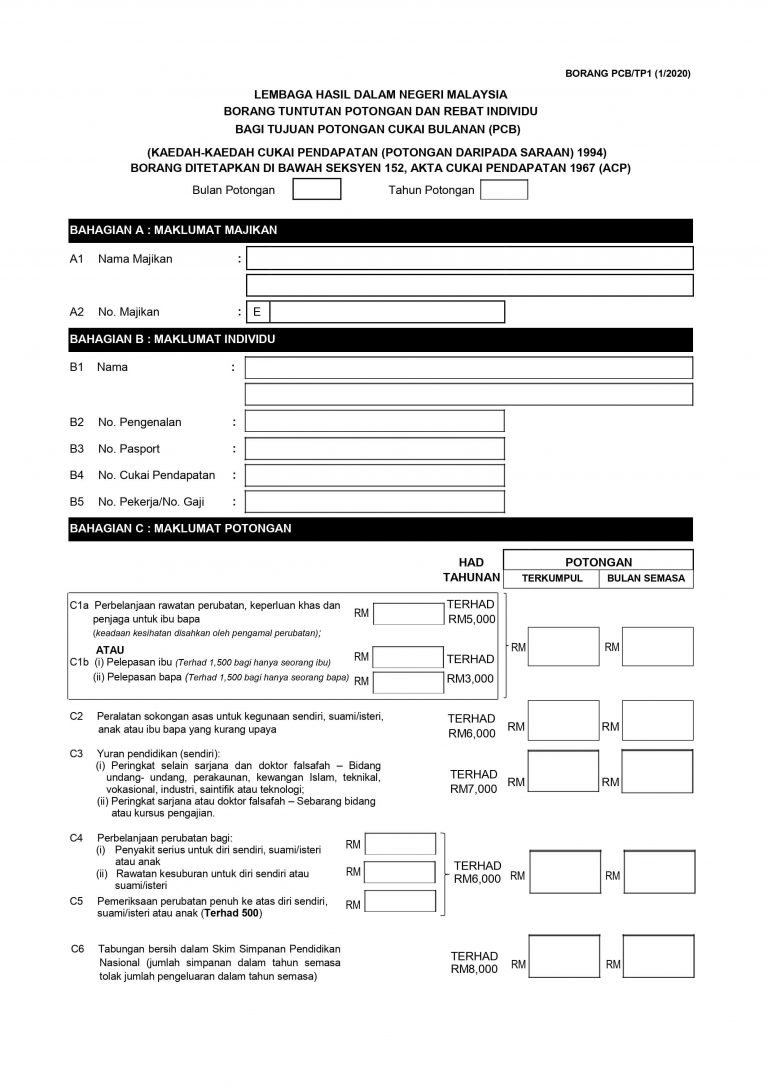

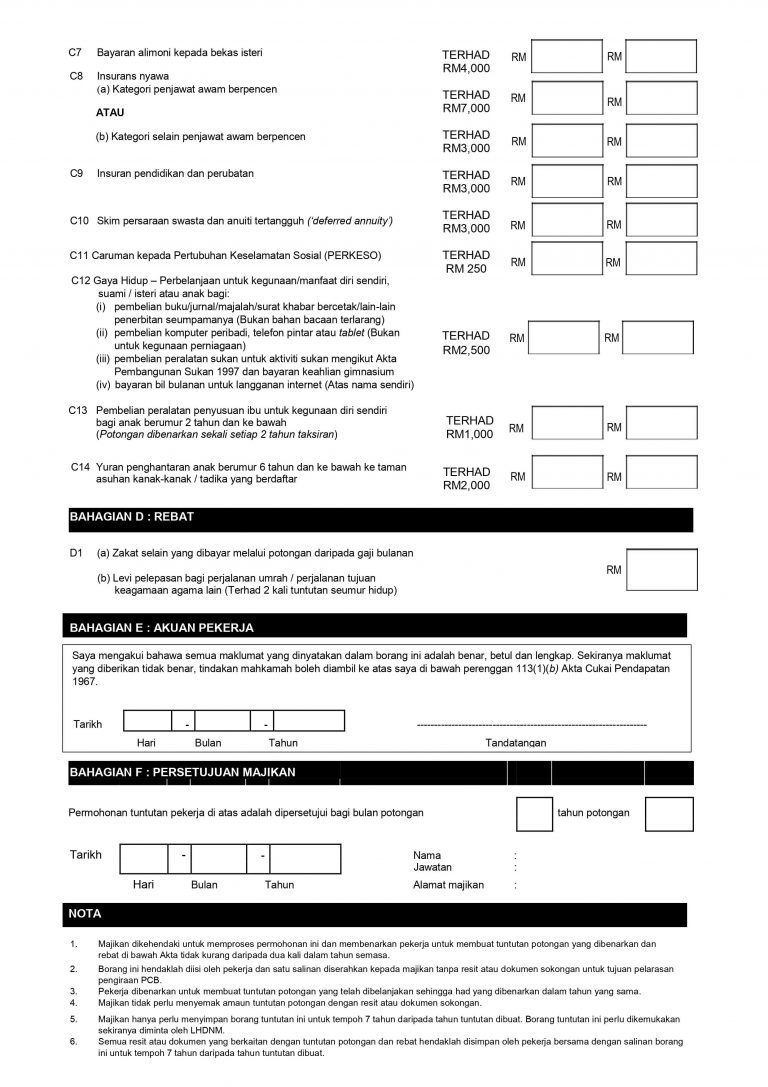

The TP1 is an income tax form that is given to the employer by the employee to ensure that the MTD (monthly tax deductions) have taken into account the necessary rebates and deductions. The rebates and deductions are for book purchases, insurance, medical expenses and others. The rate of deduction and rebates depends on the approval of the employer. It is the employer’s responsibility to inform their employees to present the TP1 form if needed. No receipts or supporting documents are required when submitting the TP1 form.

SQL Payroll Software provides Form TP1

What is the purpose of form TP2?

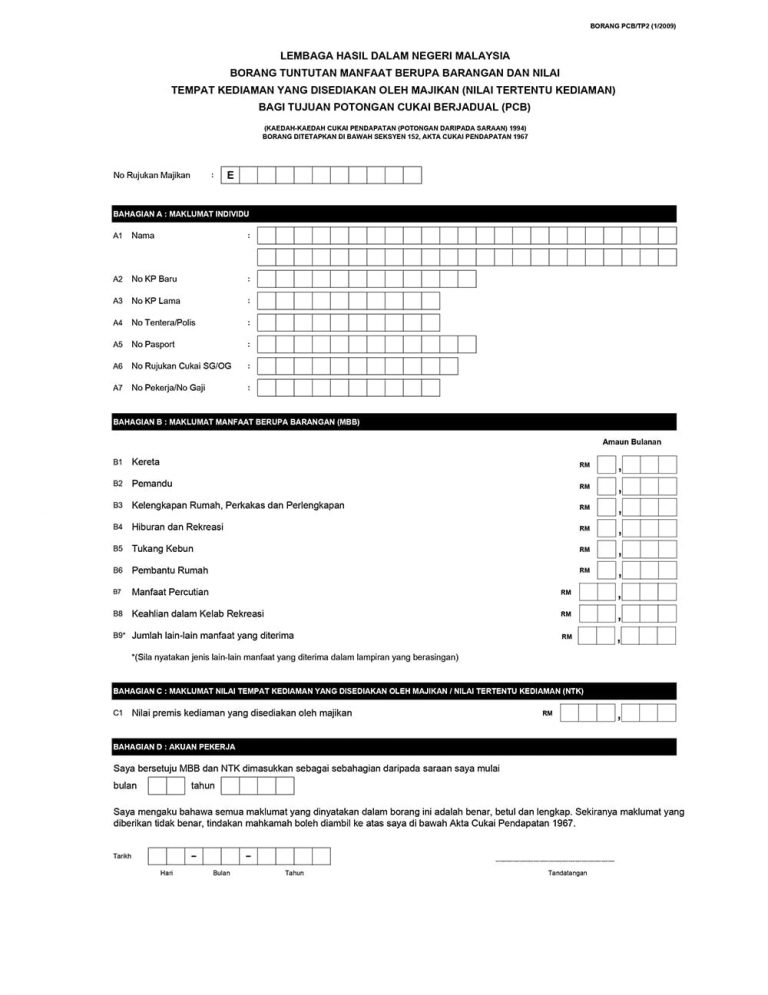

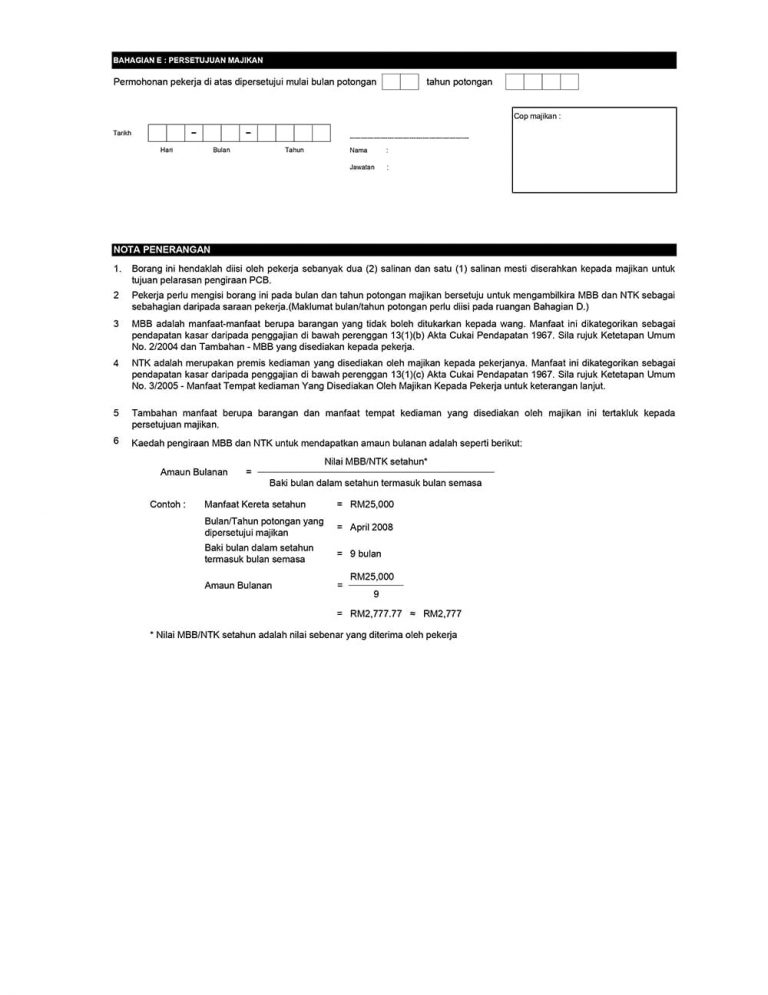

TP2 is a claim form for the benefits in kind (BIK) provided by the employer. If an employee received Benefits in kind in the form of cars, accommodation, chauffeurs, or other benefits, they are required to fill in this form every year. TP2 is a form that is needed to add the BIK that employees receive as a part of their monthly earnings to determine the PCB amount that they are subjected to. Employees are not allowed to opt out of their decision to include BIK in their PCB calculation within the same year and under the same employer.

SQL Payroll Software provides Form TP2

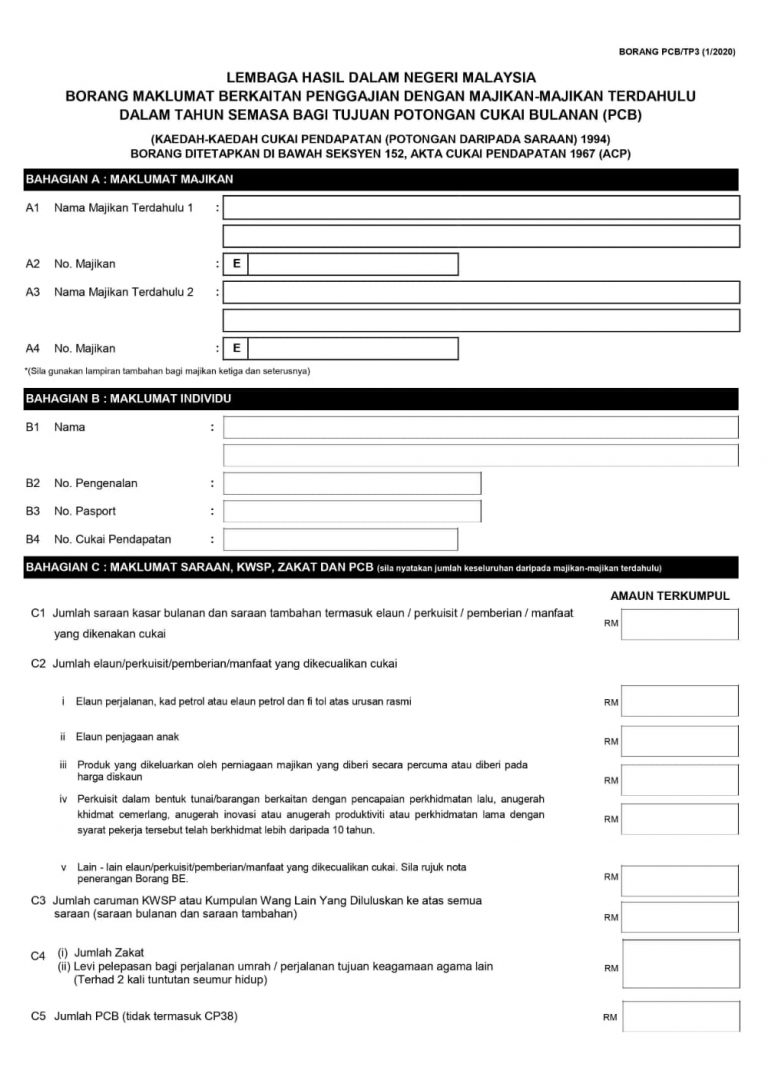

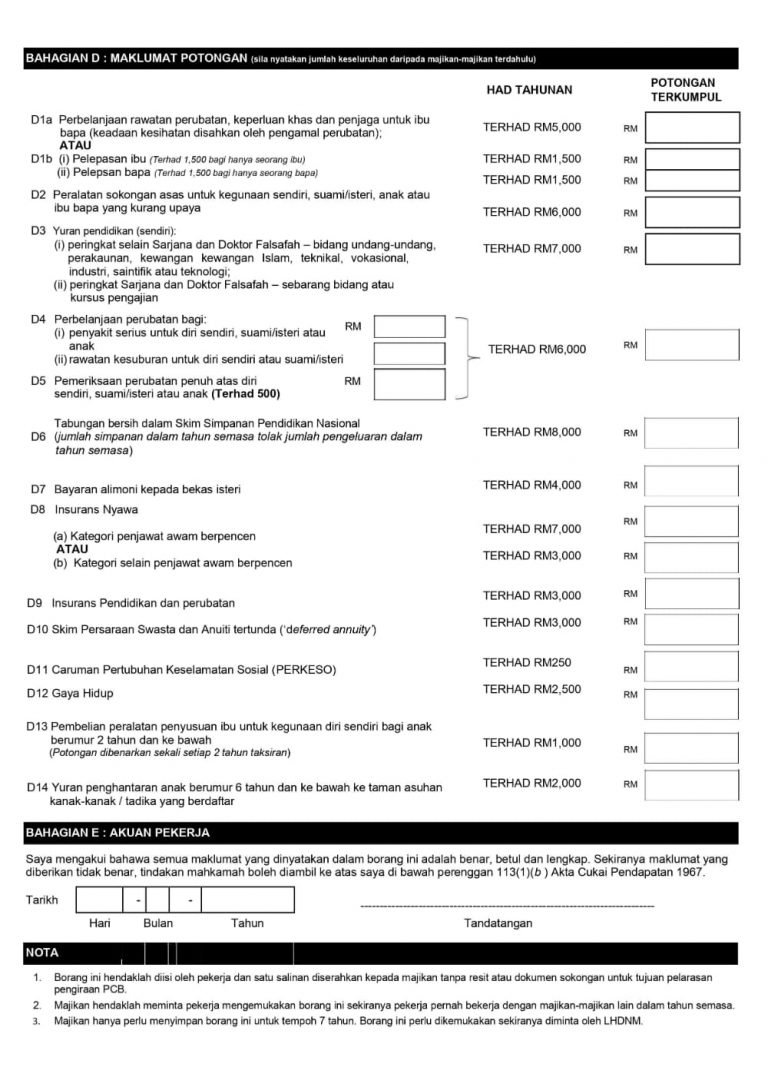

What is the purpose of form TP3?

As per Malaysia Inland Revenue Board (IRB) requirement, employee who newly joined the company during the year shall submit TP3 Form to his/her new employer to notify information relating to his employment with previous employer in the current year.

TP3 form is given to an employer containing information related to their new hired employee’s previous employment in the current year. TP3 contains information regarding the employee’s accumulated deductions while working for the past employer. These details are used to key into the opening payroll for your new employee. It is the employer’s responsibility to inform their employees to present this form if needed.

SQL Payroll Software provides Form TP3

SQL Payroll software Favoured Features

Certified by Statutory bodies & 100% accurate

electronic submission & e-Payment ready

Batch email payslip

Comprehensive management reports

Unlimited year records