What is EPF (KWSP)?

Employee's EPF rate From 11% to 9%

Effective From 01 January 2021 To 31 December 2021

- The new statutory contribution rate for employees will be in effect from January 2021 wages (February 2021 contribution) up to December 2021 wages (January 2022 contribution).

In Budget 2022 announcement, the EPF Rate 9% EXTENDED until June 2022 wages (July 2022 Contribution), after which the minimum statutory contribution rate for employees returns for 11%.

In Budget 2022 announcement, the EPF Rate 9% EXTENDED until June 2022 wages (July 2022 Contribution), after which the minimum statutory contribution rate for employees returns for 11%.

- Only employees who have yet to reach 60 years old are affected by the reduction on statutory contribution for employees.

- For those aged 60 and above, the statutory contribution for employees remains at the existing rate.

- The employer’s share of contribution remains at the existing statutory rate.

- Employees can choose to maintain their statutory rate of contribution at 11% by submitting the Borang KWSP 17A (Khas 2021) form, to their respective employers.

Employee's EPF rate From 11% to 7%

Effective From April 2020 to December 2020

- The new statutory contribution rate for employees will affect April 2020's wages (May 2020's contribution) up to December 2020's wages (January 2021's contribution) subject to the Third Schedule of the EPF Act 1991.

- The new statutory contribution rate for employees applies to those below 60 years old who are liable for contribution.

- The statutory contribution rate for employees aged 60 years old and above however, remains unchanged.

- Employees may choose to maintain the current contribution rate of 11% by completing Borang KWSP 17A (Khas 2020). This form must be submitted to the EPF via employers and will take effect from the following month.

what is subject to EPF (KWSP)?

All remuneration in money due to an employee under his contract of service or apprenticeship whether it was agreed to be paid monthly, weekly, daily or otherwise.

- Salary

- Payment for unutilised annual or medical leave

- Bonus

- Allowance

- Commission

- Incentive

- Arrears of wages

- Wages for maternity leave

- Wages for study leave

- Wages for half day leave

- Other payments under services contract or otherwise

- Service charges

- Overtime payment

- Gratuity

- Retirement benefits

- Retrenchment, temporary and lay-off termination benefits

- Any travelling allowance or the value of any travelling concession

- Payment in lieu of notice of termination of employment

- Director's fee

The above list is not exhaustive. Should require further clarification, please contact EPF Contact Management Centre at 03-89226000, enquiry or any EPF Office.

EPF Contribution Rate

| Employee’s Status | Monthly Salary Rate | Stage 1 (Below 60 years old) |

Stage 2 (Age 60 till 75) |

|---|---|---|---|

|

No limit |

|

|

| RM5,000 and below | Employees share: 11% Employer’s share: 13% (Ref Contribution Rate – Section A) |

|

|

| More than RM5,000 | Employees share: 11% Employer’s share: 12% (Ref Contribution Rate – Section A) |

|

|

|

Non-Malaysians (registered as member from 1 August 1998) |

No limit | Employees share: 11% Employer’s share: RM5.00 (Ref Contribution Rate – Section B) |

Employees share: 5.5% Employer’s share: RM5.00 (Ref Contribution Rate – Section D) |

SQL Payroll – The Best Payroll Software in Malaysia capable of handling The Most Complex PCB, BIK, And Payroll Requirements

SQL Payroll is compliant with all KWSP rules and requirements.

all employees and employer EPF contribution are automatically calculated and abides with the latest rules and rates that are set by KWSP.

our KWSP Borang A is ready for printing and can be printed for filling purpose, or submitted via e-payment. SQL Payroll is readily compatible with all Malaysian banks. Use SQL Payroll to make you next payroll processing the best experience ever.

If monthly income is RM5000.00, should the EPF contribution rate be 12% or 13%?

If an employees’ salary below RM 5000, the employer contribution rate will automatically be set at 13%. While a salary above RM 5000 will receive employer’s contribution rate of 12%. SQL Payroll will handle this automatically.

Does bonus affect Employer EPF Rate?

If an employees’ monthly wages is below RM5000, the Employer’s EPF rate will be 13%.

However, this employee has received a bonus, causing exceed to RM5000 for that particular month, the employer EPF rate will still remain at 13%. This is because the RM 5000 calculation is based on total remuneration eg wages, overtime, allowance commission but except for Bonus & director fees.

If my employee turns 60 years old this year, what should their EPF contribution rate be?

If an employee is 60-year-old above, the employee’s EPF contribution rate will be 0% while the employer’s contribution rate is 4%, as per KWSP instructions. SQL Payroll will detect the employee’s age & assign the EPF rate accordingly.

Are employees above the age of 75 required to pay EPF?

A 75-year-old employee will have 0% contribution for EPF on both parties.

Can I set a higher EPF rate for my employees in the management level?

In SQL Payroll, you can even set your own EPF rate based on your company’s policies like setting the EPF rate at 19% for employees In the management level. The employers’ contribution is tax deductible up to 19% , overwhich is not tax allowable expenses.

KWSP - E submission

Unlimited monthly free payroll software training and responsive support team

No worries if you are new with our system! We provide free payroll software training every month. Contact us to find out more! Our technical support team is fully trained and equipped to assist you via phone, email, and remote access.

Employers' Guide to EPF Services

- Determining Obligation To Contribute

These are three main elements which determine the obligation to contribute to the EPF.

- Employer

- Employee & Contract of Service/Apprenticeship

- Wages

- Person Not Obligated To Contribute

Persons stipulated in the First Schedule of the EPF Act 1991 who are exempted from making a contribution are as follows:

- All nomadic aborigines unless in any particular case the Director-General of the Department of Aborigines otherwise recommends.

- Domestic servants as defined in Section 3 of the Workmen's Compensation Act 1952 [Act273], except when employed-

- by any employer specified in the Second Schedule to this Act;

- by any society registered or required to be registered under any written law for the time being in force relating to the registration of societies or co-operative societies;

- in any business registered or licensed or required to be registered or licensed under the Registration of Businesses Act 1956 [Act 197], the Trades Licensing Ordinance of Sabah [Sabah Cap. 144], the Business, Professions and Trades Licensing Ordinance of Sarawak [Sarawak Cap. 33] or the Businesses Names Ordinance of Sarawak [Sarawak Cap. 64], as the case may be; or

- by any corporation incorporated under any written law.

- Out-workers as defined in section 3 of the Workmen's Compensation Act 1952, except when employed by any employer specified in the Second Schedule.

- Any person detained in any prison, Henry Gurney School, approved school, place of detention, mental hospital, rehabilitation centre having the same meaning in the Drug Dependants (Treatment and Rehabilitation) Act 1983 [Act 283] or leper settlement.

- Any person who is a Member of the Administration as defined under Article 160 of the Federal Constitution.

- Any person who is employed and whose country of domicile is outside Malaysia and who is in accordance with his terms and conditions of service participates in a provident fund or other similar scheme established or administered outside Malaysia.

- Any person who is employed and whose country of domicile is outside Malaysia and who has obtained prior written approval from the Board to participate in accordance with his terms and conditions of service in a provident fund or other scheme established or administered in Malaysia.

- Any person who has attained the age of seventy-five (75) years.

- Option To Contribute

Persons who are allowed to elect to make a contribution:

- A domestic servant working in a residential home and employed by a private individual (owner of the residence). A notice of option may be made using Form KWSP 16 to be submitted to the EPF with a copy to the employer.

- Foreign citizens who are employed and whose country of domicile is outside Malaysia and who enter and stay in Malaysia temporarily under provisions of any written laws relating to immigration. A notice of option may be made using Form KWSP 16B to be submitted to the EPF with a copy to the employer.

- Employees (Malaysian citizens) who have withdrawn their savings under the Migration Withdrawal Scheme before 1 August 1995 but have returned and are working in Malaysia. A notice of option may be made using Form KWSP 16B to be submitted to the EPF and a copy sent to the employer.

(Note: When an employee listed above has opted to make a contribution, both such employee and his/her employer shall be liable to contribute and the option may not be revoked.)

- Option To Contribute Voluntarily

- Persons who are given the option to contribute voluntarily: Owners of a sole proprietorship, self-employed persons, business partners and retired workers

- Any person who is:

- not an employer as defined in the EPF Act 1991; or

- not an employee as defined in the EPF Act 1991; or

- neither an employer nor an employee as per their definitions under the EPF Act 1991, and where both agree to contribute

- Option To Contribute Voluntary Excess

The employer or the employee, or both, may choose to contribute more than the stipulated rates under the Third Schedule to the EPF Act 1991.

For this purpose, the employer must complete Form KWSP 17 (Maj) while the employee needs to complete Form KWSP 17A (AHL) OR KWSP 17AA (AHL) for employers with more than one employee.

The contribution must be paid rounded to the nearest ringgit and may not be backdated.

- Notice Of Revocation For Voluntary Excess

A notice to cancel this option must be made in Form KWSP 18 (Maj) for the employer and Form KWSP 18A (AHL) for the employee.

The notice shall be effective from the month of contribution stated in Form KWSP 18 (Maj). The effective date for cancellation shall not be made in retrospective.

- Explanation About Payments That are Exempted

- Any money or payment either in the form of a service charge, a service fee, a tip or other payments which has been paid by, charged on, collected from or voluntarily given by a customer or any other person (who is not the employer) with respect to the employer's business.

- This payment is payable to an employee either in whole or in part, directly or indirectly, and whether under a contract of service between the employer and the employee or otherwise.

- In addition to section 43, an employer or any other person may at any time, with the consent of the employee,

remit to the Board-

- any funds being retirement benefits of the employee; or

- any funds from any other retirement scheme or plan relating to the employee, in any manner as may be prescribed by the Board.

- An employee or any other person may at any time remit to the Board any funds from any retirement scheme or plan relating to the employee or person in any manner as may be prescribed by the Board.

- Upon the Board receiving the funds as remitted under subsection (1) or (2), the Board shall cause the funds to be paid into the Fund in accordance with section 50.

- Employers need to obtain consent from employees in accordance with the provisions of Section 44 of the EPF Act 1991 before the transfer of Retirement Benefits.

- If the employer fails to contract the employee and have applied for retirement benefits to be credited to employee's account at EPF, employers are required to complete and sign the Undertaking And Indemnity Letter of Transfer of Employee Retirement Benefit to EPF.

- EPF Contribution Payment

The employer must pay his employee's contributions based on the rate stipulated in the Third Schedule of the EPF Act 1991.

The employer must contribute within the stipulated period, which is on or before the 15th of the month following the wage month.

The employer must initially pay to the EPF both his and the employee's shares. However, the employer may recover the employee's share of the contribution by deducting it from the employee's wage when the wage is paid to the employee.

- Contribution Month

The contribution month is the month in which contribution is payable based on the salary of the preceding month. Contribution for any given month must be paid on or before the 15th of the month.

For example, in the case of salary for January 2009, the contribution month is February 2009, and contribution must be paid on or before 15th February. (The contribution for any given month is from the salary deduction from the previous month).

- Contribution Schedule (Third Schedule)

The latest contribution rate for employees and employers effective January 2019 salary/wage can be referred in the Third Schedule, EPF Act 1991 (click to download). Employers are required to remit EPF contributions based on this schedule.

For late contribution payments, employers are required to remit contributions in accordance with the third schedule as attached below by referring to the applicable effective date. Please click on the hyperlinks below for employee and employer contribution rates:

a) Effective from 1 January 2019 (January 2019 salary/wage)

b) Effective from 1 January 2018 to December 2018 (January 2018 salary/wage up to December 2018)

c) Effective from 1 Mac 2016 to December 2017 (Mac 2016 salary/wage up to December 2017)

d) Effective from 1 August 2013 to February 2016 (August 2013 salary/wage up to February 2016)

e) Effective from 1 January 2012 to July 2013 (January 2012 salary/wage up to July 2013)

f) Effective prior 1 January 2012 (December 2011 salary/wage and previous month)

Note: The latest Adobe Acrobat Reader (at least version 8.0) is required to view, print or download the Third Schedule file.

Enquiry

Further enquiries can be directed through the following:

- Contribution With Incomplete Information (CTML)

Contribution with Incomplete Information (CTML) refers to contributions which cannot be credited to the member's/employee's account due to incomplete employee's information furnished by the employer/member through Form KWSP 6 (Form A), Form KWSP 7 (Form E), Form KWSP 16F (Retirement Benefits Transfer) or Form 15 (Schedule of Contributions Transferred from Approved Funds), or member's information that are inconsistent with the EPF's records.

- EPF membership number

- Identity Number (Identification card/passport and others)

- Name with correct spelling as per identification documents

- e-CTML at Employer i-Akaun

- The monthly contribution statement sent by the EPF to the employer. The asterisk (*) mark under the relevant employee's details refers to CTML.

- Form KWSP 1314 which is attached to the contribution statement.

- e-CTML

Employers may resolve the CTML issue through the Employer's i-Akaun. Employers can get the correct member information by using the search facility in the i-Akaun. Employers are only required to have either 12-digit identification card number or correct employee's EPF number in order to make the search.

- KWSP 1314 Form

Employers must fill in the full name, identification card number and employee's number correctly as per the employee's identification card in the column provided in Form KWSP 1314. It must be signed by the employer before it is returned to the EPF.

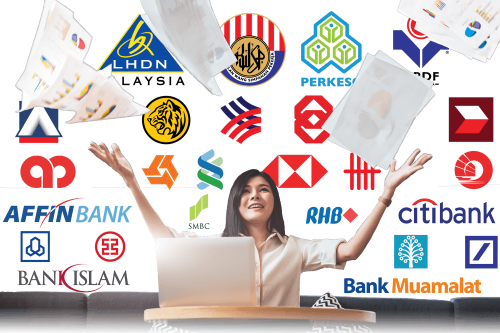

- Contribution Payment Method By Employer

Contribution payment can be made through:

i. Online banking

• Financial

Processing Exchange (FPX)

• Direct Debit Authorization (DDA)

• Bank Portal (M2U)

ii. Internet Banking

iii. Cheques

iv. Bankers Cheques

v.

Money Order / Postal Order

vi. Cash

All payments must be made to KUMPULAN WANG SIMPANAN PEKERJA.

Employers must write down employer's reference number and contribution month on the reverse side of the money order, postal order, cheque of banker's cheque.

For payments via internet banking, employers must have an account with any banks listed in a Schedule A: List of approved banking agents for internet banking.

Where to make contribution payment?

Employers can make monthly contribution payment (Form A) and any contribution payment at any EPF branches with receipt function. Contribution payments can also be sent by mail to EPF state branches and Muar.

Monthly contribution payments (Form A) together with late payment charges and dividends for overdue contribution payments can be made through any approved banking agents listed below.

Payments can be made through any bank branches and bring along the particular contribution form.

Schedule A: List of approved banking agents for internet banking

- Public Bank Bhd

- CIMB Bank

- Maybank Berhad

- Hong Leong Bank

- Citibank

- Alliance Bank

- Affin Islamic

- RHB Islamic

- UOB Bank

- OCBC Bank

- Deutsche Bank

- Ambank

- Kuwait Finance House

- Bank Islam Malaysia Berhad (BIMB)

- HSBC Bank

- BSN

Schedule B: List of approved banking agents for payments via bank counters

- Maybank Berhad

- Public Bank Bhd

- RHB Bank Berhad

- BSN

Note: Only monthly contribution payments (Form A), payments for Late Payment Charges, payments for self-contribution and payments for 1Malaysia Retirement Scheme (SP1M) can be made through bank counters.

Payment Channels

Payment can be made through these channels:

| Payment Mode | e-Caruman | Internet Banking | Banking agent counter | Epf Counter | |

|

Payment in Ringgit Malaysia |

Electronic: 1. FPX 2. Direct Debit Autorization (DDA) 3. Bank Portal (M2U) |

Electronic Contribution Payment (through banks website) |

|

1. Cash * 2. Cheque 3. Money Order 4. Postal Order 5. Bankers Cheque |

1. Cheque 2. Money Order 3. Postal Order |

|

Payment Receipt |

Official receipts can be printed via Employers i-Akaun after payment has been made online. |

EPF will not produce official receipt. Employers are advised to keep the online banking payment slip for every transaction made. | Bank payment slip is accepted as official payment receipt. | The KWSP 30 official receipt will be produced after the payment has been receipted by the EPF. | The KWSP 30 official receipt will be mailed to employers after payment has been receipted by the EPF. |

1. Starting January 2018, cash payment for Monthly Contribution Payment (Form A) will cease.

2. For other contribution payments, a maximum limit of RM500 per transaction can only be made at EPF Counter until 3pm.

3. Starting July 2018, cheque payments and money order / postal order will NOT be accepted at EPF Counter.

Click here for list of EPF Counter and Payment Function

- Late Payment Of Contribution - Late Payment Charge/Dividend

Late contribution payment refers to the payment received by EPF for a certain contribution month after the 15th of that month. Defaulting employers regardless of whether their employees opted for Simpanan Shariah or not, will be imposed with the following:

- Late Payment Charge

The lower dividend rate between Simpanan Konvensional and Simpanan Shariah for each respective year with an additional one (1) percent.

The minimum late payment charge imposed is RM10. The late payment charge will be rounded up to the nearest Ringgit denomination.

Example:

The late payment charge imposed is RM13.21 and this must be rounded up to RM14.

- Dividend

The dividend rate to be paid will be based on the lower between that of Simpanan Konvensional and Simpanan Shariah. For the years prior to the introduction of Simpanan Shariah, the calculation of late payment charges and dividend will be based on the EPF dividend rate declared for the respective years.

Late payment of contribution includes:

- Overdue contribution;

- Under-paid contribution

- Overdue Contributions

In the event that the employer fails to pay the contributions within the prescribed period, this contribution will be considered as an outstanding contribution. Under certain circumstances, the EPF will make an assessment of the contribution.

The EPF Officer will then submit Form KWSP 7 (Form E) and Form KWSP 8 (Form F). Payment must then be made using From KWSP 8 (Form F).

For unpaid outstanding contributions, payments can also be made using Form A (Online).

- Employers Contribution Statement

The EPF will periodically send a contribution statement to employers. The employer must check the accuracy of information shown in the contribution statement.

If there are errors in the contribution statement, the employer must inform the EPF in writing within one month from the date of receipt of statement.

- Retirement Benefits Transfer

The employer may, with the consent of the employee, transfer any retirement benefits to the employee's account with the EPF. The retirement benefits transfer must be made using Form KWSP 16F.

- Update EPF on Retrenchment of Workers

- Stop Employing Workers Temporarily

Employers who do not have employees for a given month need to inform EPF by mail/facsimile/ e-mail or other designated channels from time to time.

The EPF may cancel employer's reference number if the employer has no liability to contribute/no employee for a period of 6 months consecutively.

- Do not have and no intend to employees

Employers who do not have an employee and do not intend to employ an employee in the future, should notify EPF either by completing Form KWSP 6 (Form B), letters, emails or other designated channels from time to time.

Submit to the EPF within 30 days from the resignation/termination date of last employee.

The EPF will cancel the employer's reference number.

Please contact the EPF should you have employed new employee.

- Termination Of Operation

An employer who wishes to terminate the operation shall notify the EPF in writing either by completing the form EPF 6 (Form B), mail, e-mail or the other designated channels from time to time.

Submit to the EPF within 30 days from the resignation/termination date of last employee.

The EPF will cancel the employer's reference number.

- Termination Of Liability To Contribute For Foreign Workers

Beginning 1 September 2007, the liability to make EPF contributions for foreign workers will end on the last two (2) months as follows:

- Before the expiry date of the employee's work permit, or

- Before the expiry date of the employee's work extended work permit.

- Offences And Penalties Be A Responsible Employer

Know the consequences of your actions

Employers are legally required to make EPF contributions as spelt out in the EPF Act 1991 as well as the KWSP 1991 Rules and Regulations. Failure to comply is subject to penalties as listed below.

| Section | Offences | Penalties |

| 41(1) | An employer who fails to register with EPF within 7 days from the date he employs an employee. | Imprisonment term not exceeding 3 years or a fine not exceeding RM10,000 or both. |

| 43(2) | Failure to make contribution on or before the 15th day of the month. | |

| 59(a) | Make false statement orally or in writing |

| Section | Offences | Penalties |

| 48(3) | Deducts the employee's share of contributions from the wages and fails to pay to EPF. | Imprisonment term not exceeding 6 years or a fine not exceeding RM20,000 or both. |

| 47(1) & 47(2) | Deducts from the wages of any employee as part of the employer's share of contribution. |

| Section | Offences | Penalties |

| 41(3) | Fails to notify the EPF within 30 days from the date he ceased to have any employee. | Imprisonment term not exceeding 6 months or a fine not exceeding RM2,000 or both. |

| 42 (1) | Fails to furnish the statement of wages to his employee. |

| Section | Offences | Penalties |

| 46(1) | Failure of the Company's Director, Partner of the Firm or an Association of Persons to pay the outstanding EPF contribution. | Claims may be filed in court adn actions that can be taken against you:

Section 39 - The EPF Board may apply to the Immigration Department to prevent any company directors / partnership of firms / business owners from if the company / firm fails to pay the contribution as set. |

SQL Payroll software Favoured Features

Certified by Statutory bodies & 100% accurate

electronic submission & e-Payment ready

Batch email payslip

Comprehensive management reports

Unlimited year records

E Leave mobile app

Tutorial Video

Employer Tax Obligation 2018

0:10 - Introduction Employer Tax Obligation

0:34 - Employees EA Form

1:10 - Form E

1:51 - CP 8D

2:52 - SQL Payroll EA Form

3:28 - SQL Payroll CP 8D

4:15 - SQL Payroll E-Submission

2019 Tax relief decrease, monthly PCB increate