The Best

Accounting Software

trusted by more than 270,000 companies

Recent Awards

Best Accounting Software

Best Customer Service

On Going Event

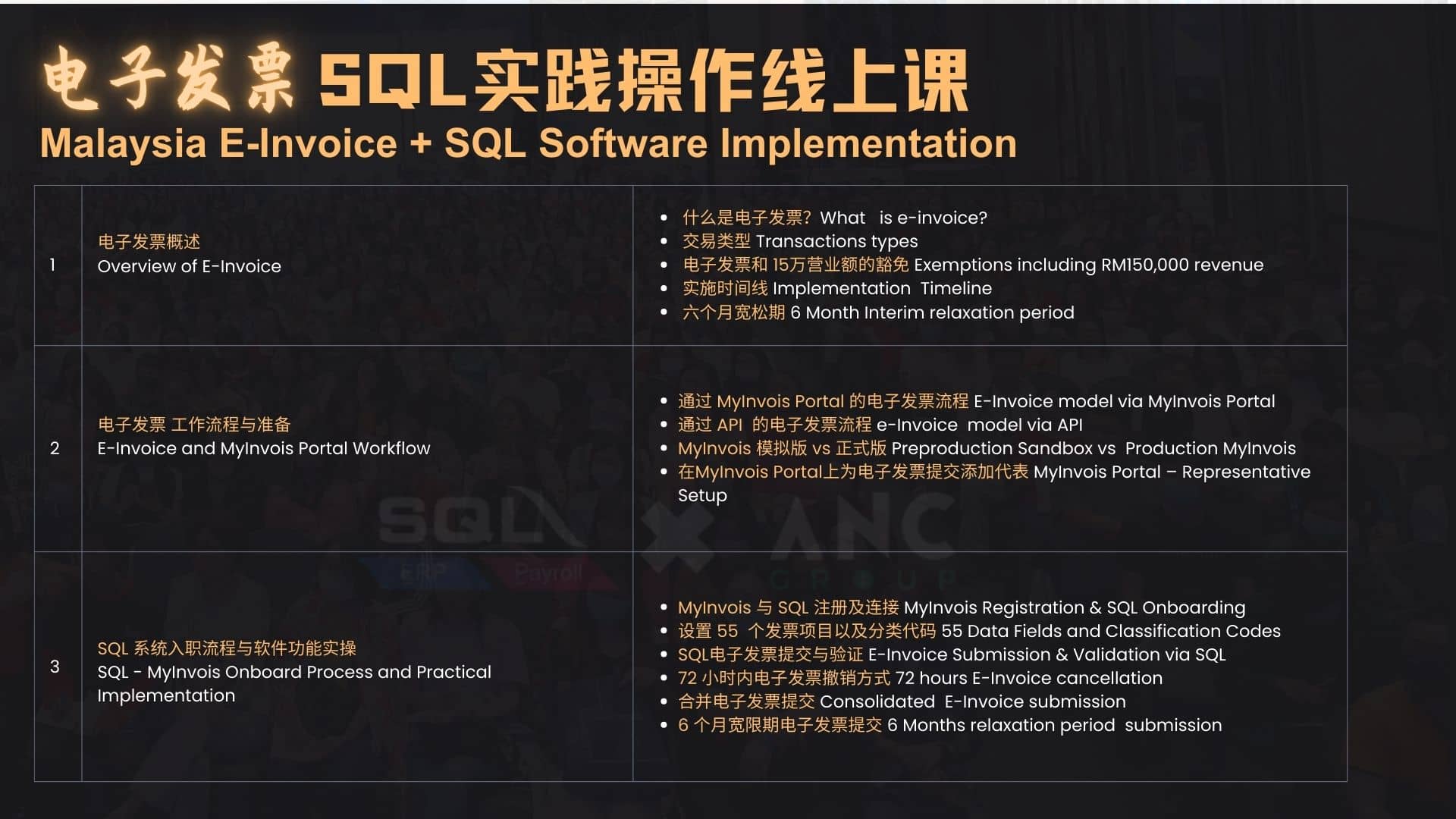

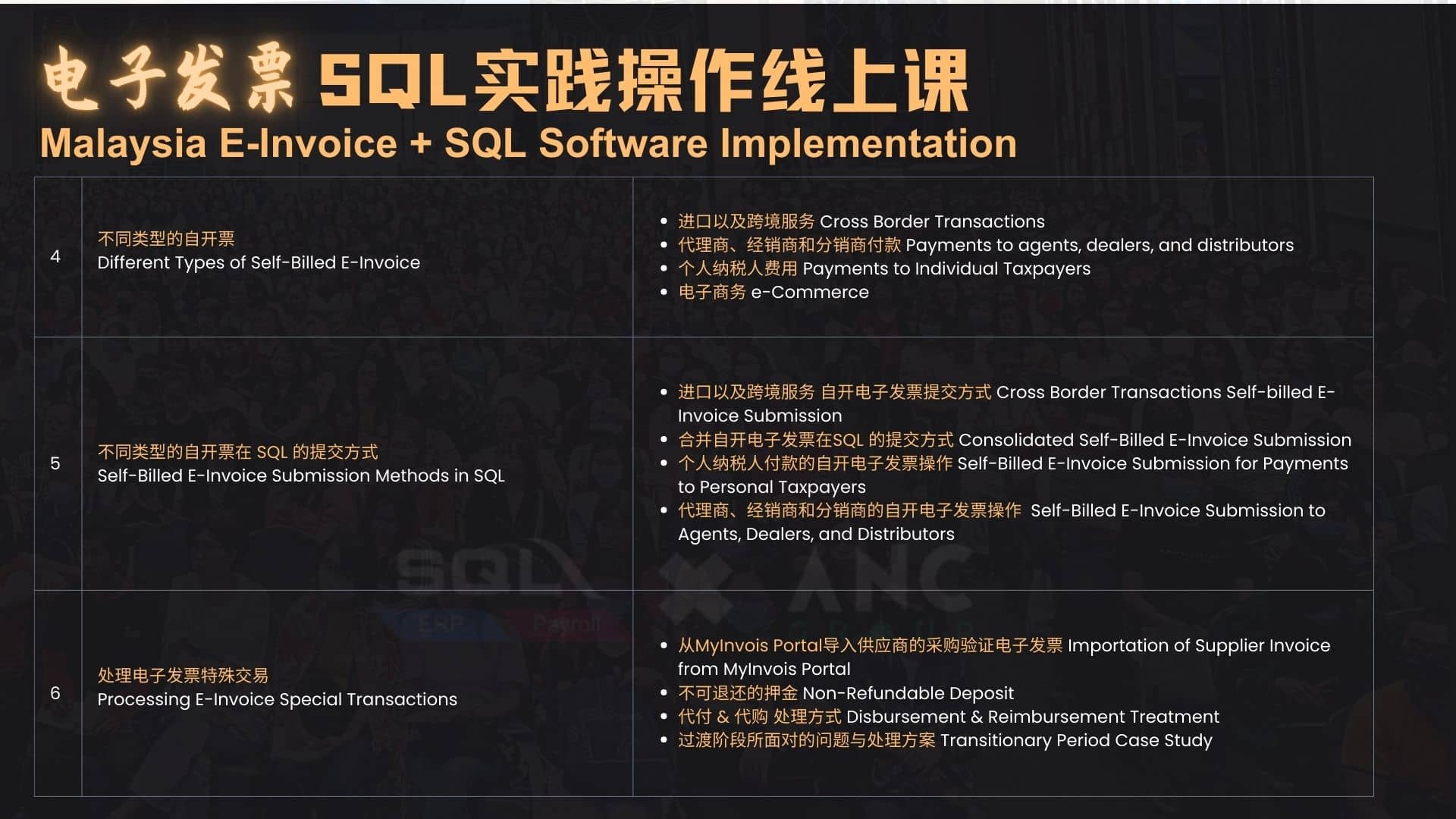

Malaysia’s e-invoicing compliance is complex, involving pre-production sandbox registration, MyInvois portal setup, 55 mandatory fields, strict submission rules, consolidated e-invoices, and self-billed e-invoices. Missing a single step could lead to costly errors and compliance risks.

This webinar offers expert-led, practical training to help you understand, implement, and comply with Malaysia’s latest e-invoice regulations. Why struggle alone when you can learn from the best? Get practical, expert-led solutions to ensure a smooth, error-free transition. Live Q&A with licensed tax professionals with real answers to real business challenges—so you can implement changes with confidence. Limited slots available—register now to secure your spot!

.

电子发票全面实施倒计时已进入关键阶段, 您是否已经完成各项准备?【SQL & ANC 实践操作线上课】一堂课,带您从基础概念到实战,全面掌握 E-Invoice 提交流程!从 MyInvois Portal 与 SQL 系统的对接设置,到电子发票 55 项关键内容的配置,从复杂交易处理到避免罚款的合规指南,课程内容覆盖每个关键细节。

确保合规无忧,点击下方报名日期,快速上手电子发票关键步骤!

𝐂𝐨𝐮𝐫𝐬𝐞 𝐇𝐢𝐠𝐡𝐥𝐢𝐠𝐡𝐭𝐬:

💎 3-Hour In-Depth Analysis: Straight to the point—this is NOT a preview class! We’ll break down every detail of LHDN E-Invoice to ensure you gain a comprehensive understanding.

💎 Key Topics Covered: Focus on critical E-Invoice content to help you quickly grasp essential knowledge.

💎 Over 1 Hour of Q&A: Get all your questions answered, from official guidance to unexpected practical solutions.

𝐂𝐨𝐮𝐫𝐬𝐞 𝐂𝐨𝐧𝐭𝐞𝐧𝐭 𝐈𝐧𝐜𝐥𝐮𝐝𝐞𝐬:

– Comprehensive A-Z Guide on E-invoice

– The latest guidelines, including Consolidated Self-Billed E-Invoice

– Key considerations for the 6-month relaxation period

– Conditions for businesses with RM150K exemptions

– Preparations required before formal implementation

– 2-second verification tests in the Pre-Production phase (Sandbox), and more!

𝐎𝐩𝐞𝐧 𝐭𝐨 𝐍𝐨𝐧-𝐒𝐐𝐋 𝐔𝐬𝐞𝐫𝐬 𝐓𝐨𝐨!

SQL has hosted over 80 offline seminars for thousands of participants. This online seminar, proudly sponsored by SQL HQ,

welcomes both SQL and non-SQL users to join!

🎟️𝐒𝐞𝐜𝐮𝐫𝐞 𝐲𝐨𝐮𝐫 𝐬𝐞𝐚𝐭 𝐧𝐨𝐰—𝐬𝐩𝐚𝐜𝐞𝐬 𝐚𝐫𝐞 𝐥𝐢𝐦𝐢𝐭𝐞𝐝, 𝐒𝐢𝐠𝐧 𝐮𝐩 𝐍𝐨𝐰!

Fee: RM 38 per ticket (Early Bird Promotion)

*An e-Certificate of Attendance is provided

2024 LHDN E-Invoice Seminar

Bosses, and Accountants, did you know that even dividends are required to be e-invoiced?

In this seminar, you will not just be learning about the laws and regulations regarding E-Invoice. Our panel of experts will also share insider guides about LHDN E-Invoices, navigating dangers, exploiting opportunities. Are accountants and bookkeepers facing risks or riches?

- Pre-E-Invoice vs. E-Invoice: What’s changed and what needs your attention?

- Do’s and Don’ts: Navigate the transition smoothly and avoid pitfalls.

- Peppol vs. LHDN E-Invoice: Demystify the difference and understand compliance requirements.

- E-Invoicing Optional for Customers: What’s the Deal?

- Foreign Workers Without Permits: Self-Bill E-Invoicing Required?

If you have any concerns about the risk factors in your business industry, by the end of this session, everyone will have the opportunity to ask questions, and our experts will provide answers to address your queries.

🆓 Limited seats, first come first serve

Fee: RM 18 per ticket

*An e-Certificate of Attendance is provided

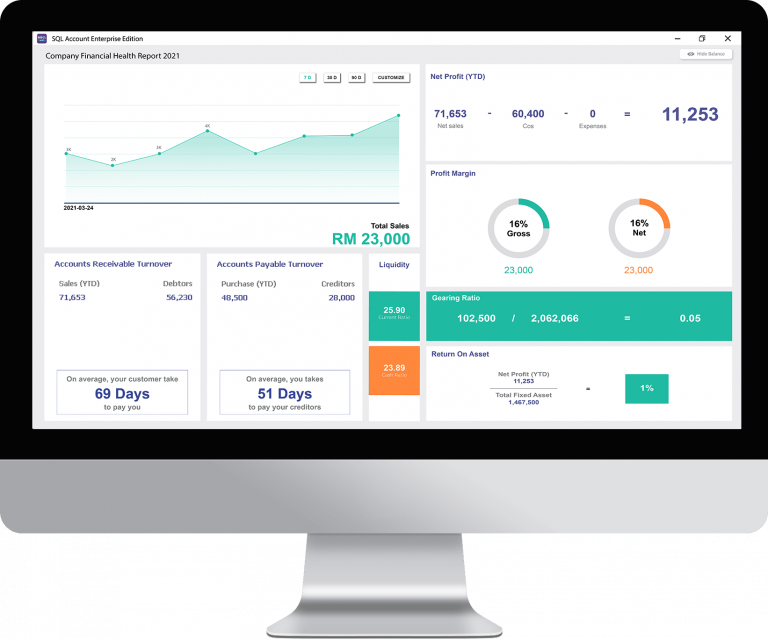

Featured Products

We empower more than 600,000 accounting and business professionals using SQL Account and SQL Payroll to perform their daily operation effectively.

SQL Account

SQL Account is an accounting software that is suitable for all businesses, from small businesses to large organizations. It is crucial to find a business solution that suits the nature of your business. The right accounting software will broaden the horizons and expand business opportunities for you.

Choose the best accounting software in Malaysia for your company. SQL Account is user friendly & can be integrated with no fuss.

Free Download Accounting Software trial to experience our accounting software.

Access Anytime, Anywhere

Batch Emails Statements

Special Industries Version

Real-Time CTOS Company Overview Reports

Advance Security Locks

Intelligence Reporting

SQL Account Popular Add-ons:

If you’re looking for a feature that is not listed here, please let us know or join our ERP Customization Group Discussion for FREE.

Join us and start using the Best Accounting Software in Malaysia!

SQL Payroll

SQL Payroll software brings simplicity into the complex nature of Human Resource management. This payroll software comes equipped with HR management, leave management, PCB tax calculator, and is compliant to Malaysia labour laws & government regulations.

Free Download Payroll Software trial to experience our payroll software.

Certified by Statutory bodies & 100% accurate

electronic submission & e-Payment ready

Batch email payslip

Comprehensive management reports

Unlimited year records

E Leave mobile app

New Features Updates of SQL Products

New Features Updates of SQL Products

With Mobile Connect, salespeople can effortlessly create orders directly from their mobile phones. Instantly connected to the server database, they can access and update order details in real time, boosting productivity and accelerating sales like never before.

Before submitting real e-invoices, you can connect to our sandbox server to practice and test the submission process. This allows you to familiarize yourself with the system and ensure everything is set up correctly, so you can submit your e-invoices with confidence.

Effortlessly retrieve your customer and supplier TIN numbers through simple SQL queries, making it quick and easy to gather essential information for e-invoicing.

Enhance your workflow and productivity — start using our SQL Products today!

SQL Account is the Best Accounting Software among all. SQL Account is Number 1 Accounting Software in Malaysia.

Our Customers

More than 270,000 companies use SQL Account & SQL Payroll for business daily operation

Our Business Partners

CTOS x SQL

Evaluate your new client before offer any credit terms.

View More

RHB x SQL

Connect your RHB Reflex Premium Plus with SQL Account.

View More

Maybank

Seamlessly connect your Maybank2u, Maybank2u Biz accounts to SQL Account.

View More

ipay88 x SQL

Accelerate your customer payment collection with SQL Account’s eInvoice.

View More

Education Partners

Online Resources

Accountant, when come to Borang B & Borang B submission, a common question may ask from your customers:

I just want tax payable RM 8000 only, how much yearly income do I need to report to LHDN? What us my tax bracket %?

Popular Articles

Starting August 1, 2024, businesses will need to validate all invoices issued to buyers. You can issue e-invoices either directly through the LHDN official MyInvois portal or via API integration with third-party software connected to the MyInvois portal. Regardless of the method you choose, registering on the MyInvois portal is mandatory. Follow the steps below to complete your registration.

How SQL Make Your Work-Life Easier?

SQL Account Movie (Warehouse) - How to get Good Incentives

SQL Account Movie (Sales Person) - Deserve to own luxury bags & premium watches

SQL Account Movie (Boss) - 10 months bonus, tripled sales in a quarter

SQL E Leave

SQL E Claim

Testimonial