What is Profit & Loss Statement?

What is Profit and Loss (P&L)?

The term “profit and loss” is used in reference to a Financial Statement that gives us a summarised overview of a company’s revenues, expenses, and profit / loss over a given period of time. Usually across a 12-month financial period. It is also common for companies to generate their Profit and Loss Statement in quarters or monthly depending on the company’s business nature and the period of data that they wish to analyse.

The Profit & Loss Statement is one for the three financial statements that every public company must issue quarterly and annually. The other two financial statements are Balance Sheet and Cash Flow Statement.

What is the difference between Profit & Loss and Balance Sheet?

Profit & Loss shows the income, expense, and profits over a certain period of time. Where else Balance Sheet shows a snapshot of the company’s assets and liabilities up to a certain date. Investors use Profit & Loss Statement to see the profitability of a company and to calculate the return on equity. Balance sheet is used to evaluate the company’s financial strength by comparing the amount of assets against the liability.

Profit & Loss Financial Statement is generated based on accrual accounting method. This means that revenues and expenses are recorded at the time of the transaction instead of the time when payment received.

It is important to note that P&L statement changes over time. So, it is crucial to compare this financial statement from different periods to get the best reading of the company’s financial performance.

By analyse the P&L Statement, we can see the company’s ability to generate sales, manage expenses, and create profit.

How to calculate Profit & Loss?

P&L in SQL Account is calculated by summing all the businesses revenue sources and deducting the business expenses expenses that are related to the revenue.

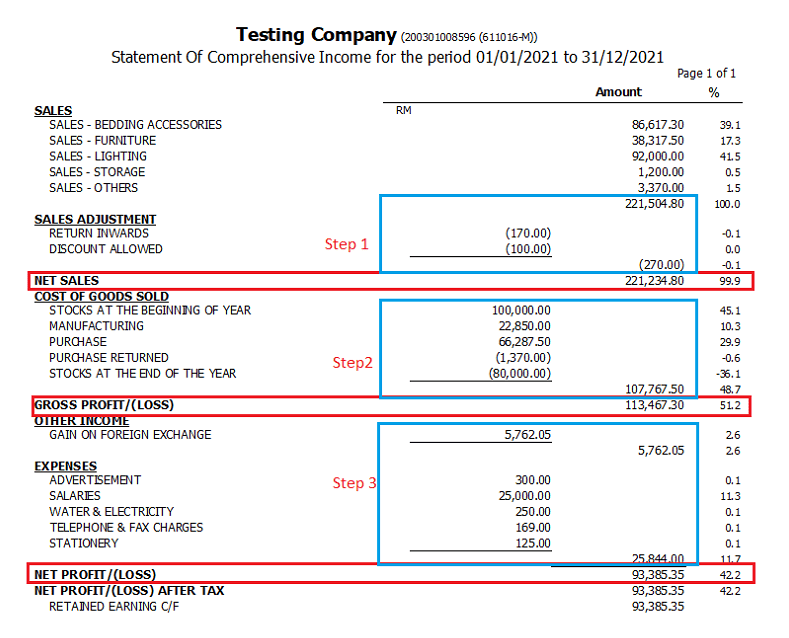

Step 1:

All sales accounts are totalled up to obtain total sales amount. The sum is the minus against the sales adjustment accounts like Return Inwards and Discount accounts. The final figure is called the Net Sales.

Step 2:

Once we have the Net Sales amount, we will minus out the amount of our Cost of Goods Sold. This will give us the Gross Profit / Loss.

* How is the calculation of Cost of Goods Sold done?

Cost of the Goods sold = Stock at the Beginning of the Year + (Purchases – Purchase Returns) – Stock at the end of the year

Step 3:

The last step is to get the Net Profit/Loss. Net Profit/Loss = Gross Profit/Loss + Other Incomes – Expenses

Download SQL Accounting Software for a free trial of up to 500 transactions.

You can keep track of your daily sales, purchase costs, and expenses, and a profit and loss statement will be generated immediately.

How can SQL Account improve your profit & loss statement?

SQL Account's Profit & Loss statements comes with these amazing features:

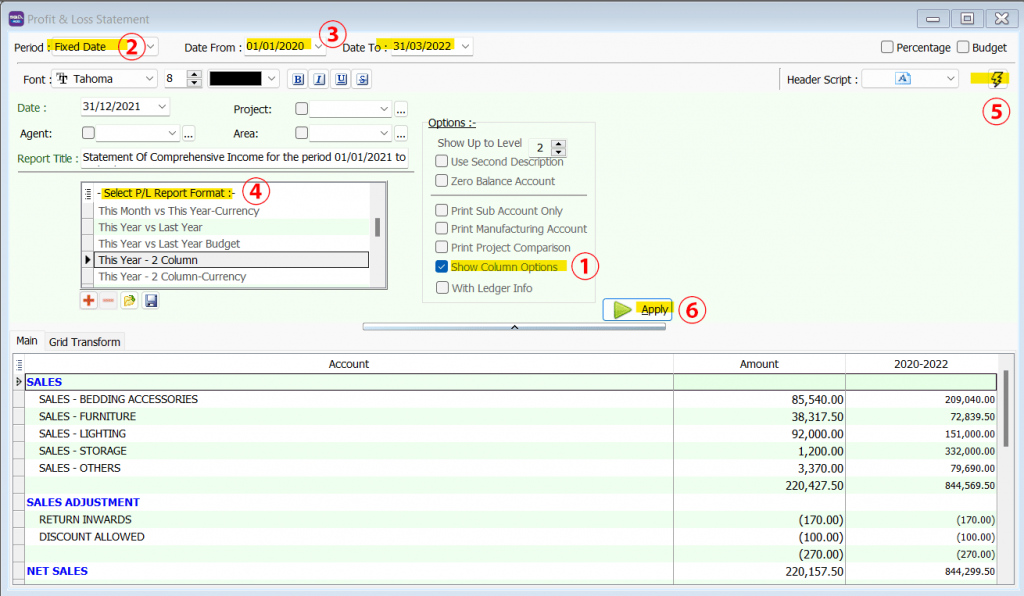

Flexible to customize Profit & Loss calculation period

Profit & Loss Financial Statements are traditionally based on financial period which is a 12-months period. But with SQL Account, you can customize your P&L Statement to show an 18-months financial period calculation. If your company has projects that runs across financial periods (eg: Construction companies), you can select any start and end period for your Profit & Loss Statement.

Your can also set the Profit & Loss to be based on calendar year from January – December even if your financial period if from 1 July to 30 June. This is useful because some companies are required to see the annual company performance in order to determine the bonus distribution rates. Most softwares are unable to do this. But with SQL Account, you can.

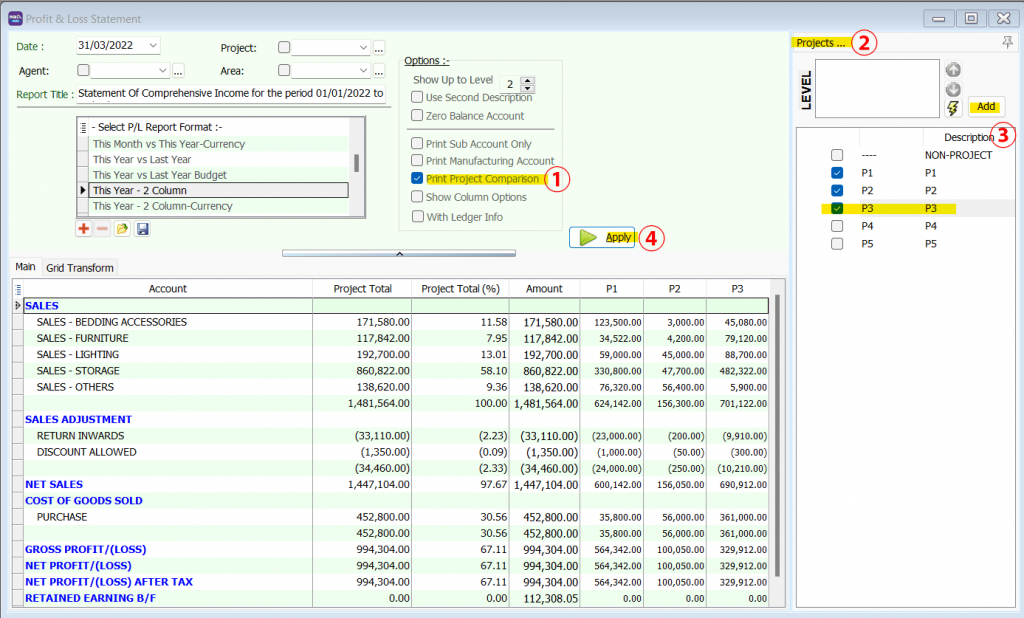

View Profit & Loss based on projects

For project-based companies, you can separate the expenses and revenues based on projects . You can also compare multiple years of financial performance in one screen. Just set the date, choose the report type, click apply and you’re all set. You can compare 3, 4 or even more years of financial statement all in one glance.

Monthly & yearly comparison of Profit & Loss

With SQL Account, you can compare your last year this month’s P&L vs this year this month’s P&L for accurate comparison. The same can be done for this year vs last year. You can compare more than 2 years of pass Profit & Loss. P&L statement changes overtime, in order to get a better understanding of the company’s financial health, we should compare current statements with the past to get a clearer picture of the company’s performance.

Profit & Loss Consolidation

SQL Account has a feature that lets you aggregate the financial statements from a group of companies as a consolidated financial statement. View the Profit and Loss from multiple companies all in one screen.

How to customize Profit & Loss Report period in SQL Account?

- Tick the checkbox “Show Column Options”

- Set Period to “Fixed Date”

- Key in your desired date

- Select the Report Format

- Click “Add”

- Click “Apply”

If you want to see the Profit & Loss based on project:

- Tick the checkbox “Print Project Comparison”

- “Projects” tab will appear on the right side of the screen, click it

- Select the projects you want then click the “Add” button

- Click “Apply”

Tutorial Video

SQL Accounting Software Favoured Features

SQL Account is an accounting software that is suitable for all businesses, from small businesses to large organizations. It is crucial to find a business solution that suits you. We cater for every industry. Small business, cloud accounting software, to on-premise accounting software, choose the best fit for your business. SQL Account is user friendly & can be integrated with no fuss.

Free Download Accounting Software trial to experience our accounting software.

Access Anytime, Anywhere

Batch Emails Statements

Special Industries Version

Real-Time CTOS Company Overview Reports

Advance Security Locks

Intelligence Reporting

SQL Account Modules

General Ledger

It’s easy to manage and track your company’s accounting records

Customer

Keep your customers in touch

Supplier

Manage and keep your supply chain in check

Sales

More time. For Sales.

Purchase

Be cost effective.

Stock

Helps take control of your inventory effortlessly