How to check income tax number online?

To ensure compliance with tax regulations, businesses that pay commissions to agents and distributors must complete the CP107D form for agents who surpass the specified threshold. This form entails providing crucial details such as the agent’s full name, income tax number, identification number, current mailing address, gross payment amount, and 2% withholding tax amount.

To simplify the process of obtaining income tax numbers, the Inland Revenue Board of Malaysia (LHDN) offers an official portal. This portal serves as a centralized platform that streamlines tax-related tasks, providing convenience and efficiency to users. By utilizing this portal, businesses can access the necessary information required to fulfill their tax obligations.

Now, let’s delve into the step-by-step process of searching for an individual’s income tax number online using the official portal provided by the Inland Revenue Board of Malaysia (LHDN). By following these simple steps, you can ensure compliance with tax regulations and streamline your operations effectively.

With the importance of income tax numbers established and the significance of the official portal provided by LHDN highlighted. By adhering to these steps, businesses can efficiently fulfill their tax obligations and maintain compliance with tax laws.

Steps to Check income tax number online

- Go to https://mytax.hasil.gov.my/ and click on the “e-Daftar” option.

- Choose the appropriate taxpayer category, such as individual or company. Fill in the identification number, email address, phone number, and enter the security phrase as prompted, then click search.

- The registered income tax number and LHDN (Inland Revenue Board of Malaysia) branch details will be displayed.

- If the person has never registered before, or if you enter an incorrect email or phone number, you will not be able to search for the income tax number. In such cases, you will receive a message indicating the issue as below.

In conclusion, when your company pays commissions to agents, it is crucial to prioritize tax compliance by not only searching for income tax numbers but also preparing the necessary forms, CP58 and CP107, for every agent who exceeds the prescribed threshold in the preceding year. To ensure accuracy and efficiency while eliminating manual preparation errors, consider utilizing the SQL Accounting software.

By booking a free demo of SQL Accounting software, you can experience the benefits of a fully compliant accounting solution for your company. With SQL Accounting, you can effortlessly generate both CP58 and CP107 forms, saving time and minimizing the risk of manual mistakes. The software ensures full compliance with tax regulations, providing you with peace of mind and allowing you to focus on your core business operations.

Don’t let manual preparation processes hinder your tax compliance efforts. Get started with SQL Accounting software today to streamline your company’s accounting processes, enhance efficiency, and ensure full compliance with CP58 and CP107 requirements. Take advantage of this opportunity to simplify your tax compliance journey and drive your company’s success.

Why Struggle alone? Get Step-by-Step Guidance

– Learn from E-Invoice & SQL Experts!

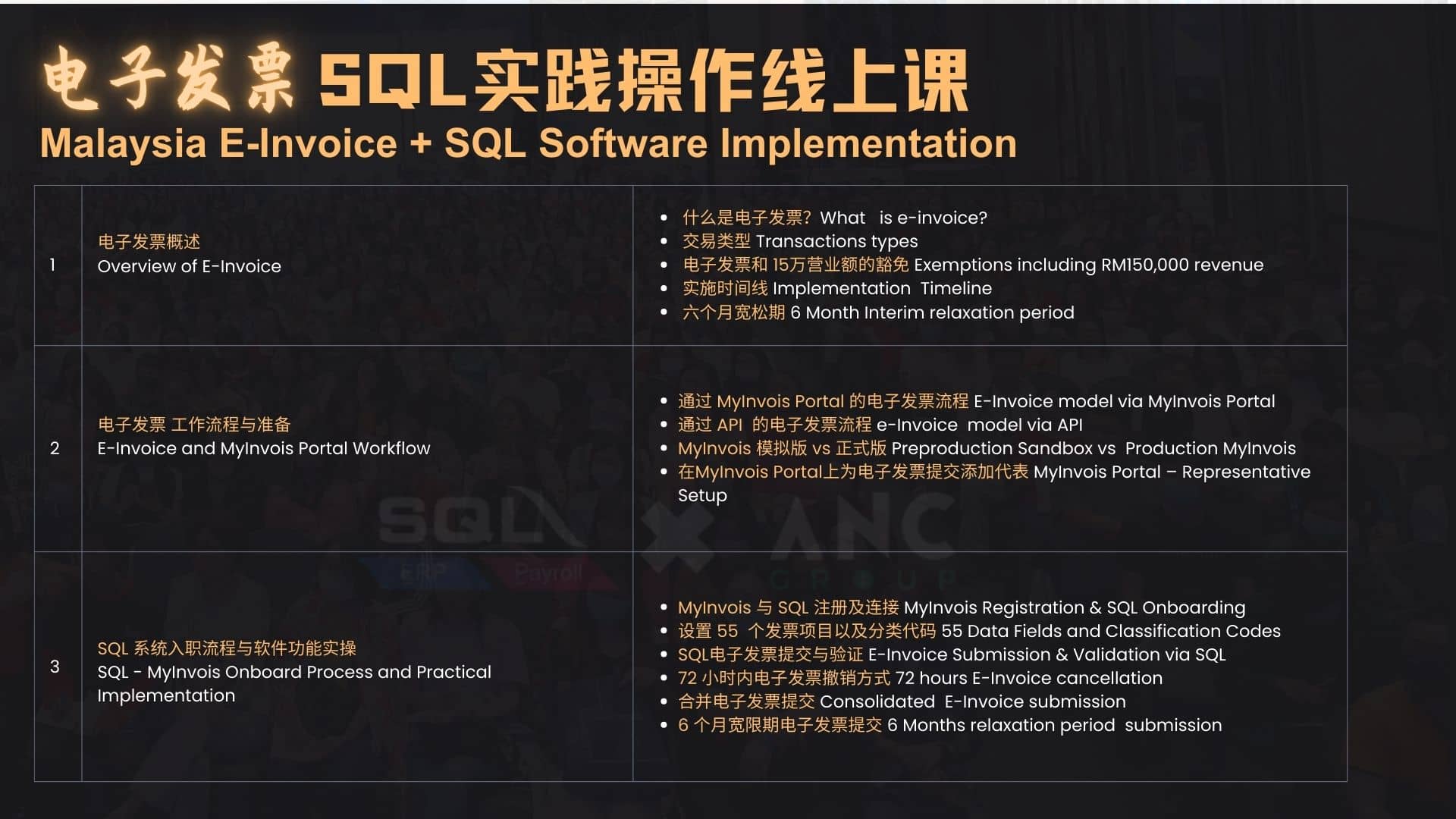

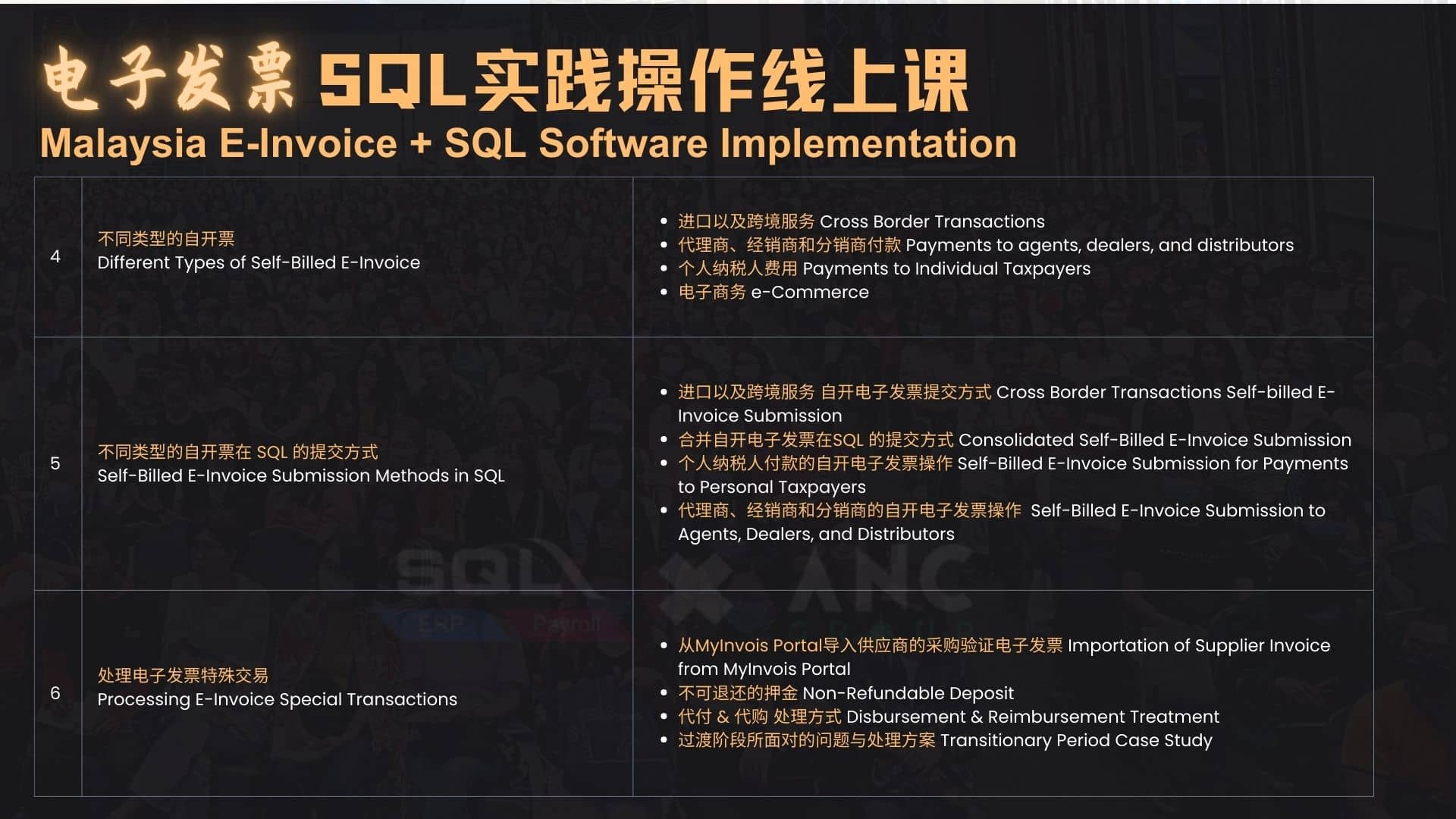

As Malaysia’s mandatory e-Invoice rollout nears, the SQL & ANC Practical E-Invoice Online Course –【June Extended Edition】 offers a step-by-step, hands-on training designed to ensure you truly understand, apply, and master the full submission process. From MyInvois and SQL system integration to configuring 55 key fields and handling complex transactions, our expert trainers Mr. Song Liew & Ms. Meldy Ong will guide you every step of the way. With extended time until 4PM at no extra cost, this HRD-claimable course ensures you can confidently manage e-Invoicing in real business scenarios. Early bird price remains at RM299—limited slots available!

.

马来西亚电子发票政策即将全面落实,【SQL & ANC 联合主办|6 月 加长版 电子发票实战操作课】将以手把手、一步一步带您掌握从LHDN系统设定到实际提交的完整流程。课程涵盖 MyInvois 与 SQL 系统对接、55 项关键字段设定、复杂交易处理及合规技巧,由两位讲师Mr. Song Liew & Ms. Meldy亲授,确保您听得懂、学得会、操作得出。课程延长至下午 4PM,无需额外收费,HRD 100% Claimable,早鸟价仍为 RM299,名额有限,立即报名!

SQL Accounting Software Favoured Features

SQL Account is an accounting software that is suitable for all businesses, from small businesses to large organizations. It is crucial to find a business solution that suits you. We cater for every industry. Small business, cloud accounting software, to on-premise accounting software, choose the best fit for your business. SQL Account is user friendly & can be integrated with no fuss.

Free Download Accounting Software trial to experience our accounting software.

Access Anytime, Anywhere

Batch Emails Statements

Special Industries Version

Real-Time CTOS Company Overview Reports

Advance Security Locks